Top States to Consider for Real Estate Investment

Top States to Consider for Real Estate Investment

Blog Article

Ranking the Best States for Real Estate Opportunities

Property remains one of the most reliable expense options available, giving opportunities for regular income and long-term growth. But, not totally all markets or best state to invest in real estate provide similar returns. Understanding where you should spend can significantly influence your profitability. Below, we explore key facets and major areas for optimum returns in actual estate.

Essential Facets to Consider

1. Population Growth

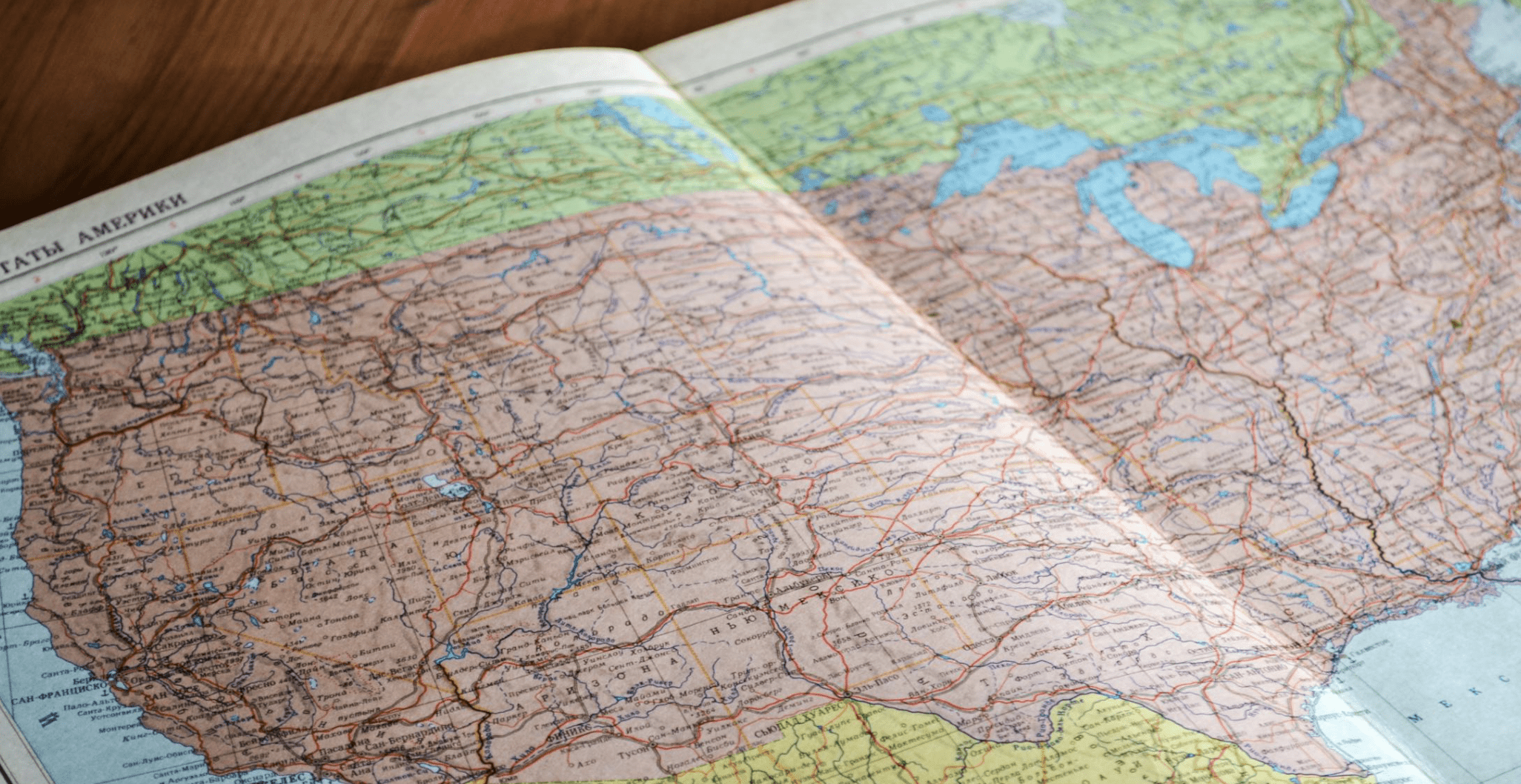

Areas experiencing rapid populace development tend to see improved property demand. High-demand parts usually result in climbing property prices and hire rates, benefiting investors. According to the U.S. Census Bureau, claims such as Texas, California, and Arizona have observed considerable citizenry development lately, pushed by powerful job prospects and affordable living.

2. Job Industry Power

Parts with sturdy job markets usually offer better returns due to higher hire demand. Towns like Austin, Seattle, and Raleigh are experiencing work booms, especially in industries such as tech, healthcare, and finance. This makes these cities beautiful for buy-and-hold income properties.

3. Affordability and Cost Gratitude

Affordability is not only essential for customers; it also signs possibility of appreciation. Cities with good price-to-income ratios, such as Detroit and Cleveland, often provide possibilities for cost-effective entry factors with space for value growth. Compare recent listing rates with traditional information from web sites like Zillow to examine gratitude potential.

Most readily useful Expense Areas

1. Austin, Texas

Austin stays a top musician in the actual estate market, powered by powerful work development in the technology sector and a steady citizenry increase. Hire yields listed below are persuasive for investors, coupled with consistent home cost appreciation.

2. Tampa, Texas

Tampa's real estate is buoyed by economic growth, an influx of new residents, and a competitive hire market. With an average hire produce of approximately 7.5%, this coastal city provides opportunities for vacation rentals and long-term leases alike.

3. Boise, Idaho

Boise has fast received attention within the last decade due to its inexpensive of living and quality of life. Information shows home prices in Boise have become by almost 20% in the past year, which makes it a lucrative industry for long-term investors.

4. Charlotte, North Carolina

Charlotte features a diversified economy and climbing population. Expense houses in the Queen City often yield attractive rental earnings, as need for housing continues to climb.

Ultimate Thoughts

For maximum results in real-estate, give attention to areas with powerful citizenry growth, expanding work markets, and impressive affordability metrics. Emerging places like Austin and Tampa provide a wealth of possibilities, while up-and-coming cities like Boise maintain outstanding promise. Strategic study and understanding of important market metrics will put you on the path to reaching sustainable real estate investment success. Report this page